Social Security Basics

Social Security Overview

Social Security can help retirees and those who become disabled or widowed from suffering financial hardship. As of mid-2019, approximately 177 million people worked and paid Social Security taxes, and about 64 million people received monthly Social Security benefits.

But, while this program could provide you with at least some type of income-related safety net, Social Security was never meant to be the only source of income for retirees. So, having a good understanding of the Social Security program can help you to maximize your benefits while at the same time coordinating any of the other safe funds for retirement that you may have.

What Benefits are Offered Through Social Security?

Social Security provides a number of benefits for those who qualify, including:

- Retirement income (for workers, spouses, and qualifying ex-spouses)

- Disability income

- Survivors benefits

If an individual who is eligible for Social Security passes away, a one-time payment of $255 may also be made to the person’s spouse (or to their minor children, in some cases).

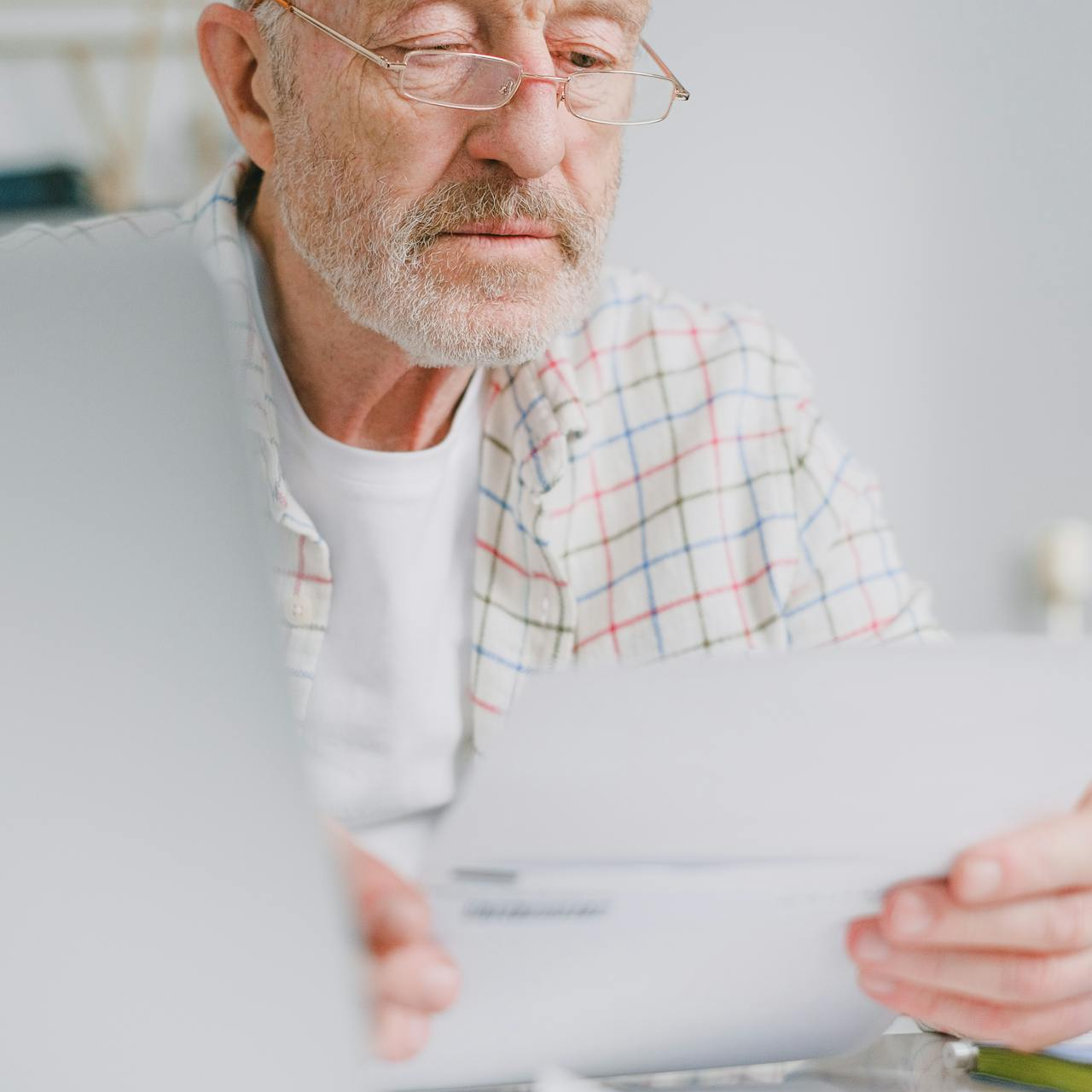

Who is Eligible for Social Security Retirement Benefits?

To be eligible for Social Security retirement benefits, you must be at least age 62 and have worked in a covered job where you (or your spouse) paid taxes into the system. You must also have accumulated 40 “work credits.” Currently (in 2020), one work credit is equal to $1,410 in income that you earn. You can accumulate up to four of these credits per year.

Provided that you have met these criteria, you can start to receive your full Social Security retirement benefits when you have reached your FRA or full retirement age. Your FRA is based on the year you were born.

Social Security Full Retirement Age

| Year of Birth | Minimum Retirement Age for Full Benefits |

|---|---|

| 1937 or Before | 65 |

| 1938 | 65 + 2 months |

| 1939 | 65 +4 months |

| 1940 | 65 +6 months |

| 1941 | 65 +8 months |

| 1942 | 65 +10 months |

| 1943 to 1954 | 66 |

| 1955 | 66 + 2 months |

| 1956 | 66 + 4 months |

| 1957 | 66 + 6 months |

| 1958 | 66 + 8 months |

| 1959 | 66 + 10 months |

| 1960 or Later | 67 |

Source: Social Security Administration

In some cases, it can make sense to begin collecting Social Security retirement income as early as age 62. However, if you start these benefits prior to your full retirement age, the dollar amount will be reduced permanently.

Taxation of Social Security

You could also have up to 85% of your Social Security benefit taxed if you start taking these benefits early. You are also receiving income from various other sources, such as wages or self-employment income.

Conversely, you can wait until after your FRA to start receiving Social Security retirement income. If you do so, the amount of your benefit can be increased. In fact, you can earn a “delayed retirement credit” of approximately 8% per year for each year that you wait up to age 70. In addition, even if you earn income from other sources, once you have reached your FRA, your Social Security income won’t be taxable.

How to Coordinate Your Social Security and Other Retirement Income Sources

Because you might have lifetime income from a variety of different sources – including Social Security – it can help to work with a retirement income specialist who can work with you on coordinating all of your payments and maximizing the amount that you receive.

If you would like to schedule a strategy session to discuss what’s the best retirement plan for you and how to meet – or even exceed – your income goals, feel free to contact us at info@certifiedsafemoney.com to set up a time that works for you.

Recent Articles

Are you a Safe Money or Retirement expert? Apply for a free listing!

Are you a Safe Money or Retirement expert? Apply for a free listing!

Find The Most Credible,

Highest-Rated Safe Money Advisors

If You Are Nearing Retirement Or Already Retired, Finding The Right Financial Advisor Who Fits Your Needs Doesn’t Have To Be Complicated.

Our Free Tool Matches You With The Highest-Rated Financial Advisors In Your Area.